Week 18 is almost here, which means it’s time for my weekly betting preview. This will get out shortly before the Super Bowl begins; not the best time to drop a hockey blog post, but here we go! My morning was busy putting the finishing touches on my new over/under model, which has now been automated and promoted to my “Small Council” replacing the algorithm Formerly Known As Prime, who is now dead last in my Q3 OU rankings. xPrime will still be tracked and results shared in my reports, but the picks won’t be displayed in my graphics anymore. It stayed in the top job longer than deserved based on performance metrics. This preview is explaining some new/upgraded) team members before sharing my picks for all 4 Monday games.

Before we go any further, it’s time for my obligatory *DISCLAIMER* it needs be noted that I’m not betting with real money. These are all fictional wagers in a spreadsheet. My mission is to engage in a mass betting campaign, picking a winner of every single game, every over/under, because it provides a complete dataset for macroeconomic analysis, which can be shared with you, shedding light on what worked and what failed. I’m also tracking the results of betting every outcome, to help me (and you) uncover previously unknown or newly emerging profit vectors. What started as a thought experiment has evolved into much more.

Introducing Game Sum 2.0

Despite telling myself to stop building new betting models, the temptation to investigate another idea was too much. At least this is one works just as well in the playoffs, which was part of the plan. It's the same premise as my old Game Sum model, but fit to a 4000-game sample. Building didn't take too long, piggy-backing on the scaffolding of my last weekend construction project. It adds up the betting results of each team's last 5 road or home games and makes picks on the results. The catch is, it doesn't always bet the team with the best results. It looks at the betting results from the last 30 days, but really only cares about which total is the largest. Once that’s established, there are a few secondary parameters

I'm not building any new models that are not fit to a giant sample of games including playoffs. The original "Game Sum" was not fit to data. I just added up the results and made a pick proportional to the amount. Not sure why I didn't think to do it this way the first time. My skills as a model builder have evolved considerably since November, as each new project imprints new wisdom on my process. The size of my “historical sample” grows larger with each passing game. This is my 5th season recording all the lines for every game (not just the lines for my picks), so it’s not just a matter of me getting smarter, but also, I began exploring ways to weaponize my database.

Game Sum 2.0 officially replaced Goalies vs Teams in my 2nd half Tournament of Models. There may be a few growing pains as there are many moving parts in my model automation, and there are inevitably mistakes waiting to be uncovered. Even if a premise is successful in the laboratory, I need to see the automated real-life version function successfully before becoming a true believer. One of the reasons I wanted to stop model building is because I need to focus more on my current team and understanding their strengths and weaknesses. But resurrecting the Game Sum concept fit to a large sample (including playoffs) had entered my brainstorming process a few weeks ago.

Looking at the cerebral cortex, you’re welcome telling Icarus he’s flying too close to the sun. That’s a lot of compartments, but the samples within are comfortably large, at least the foundational pieces that most games will be funneled into.

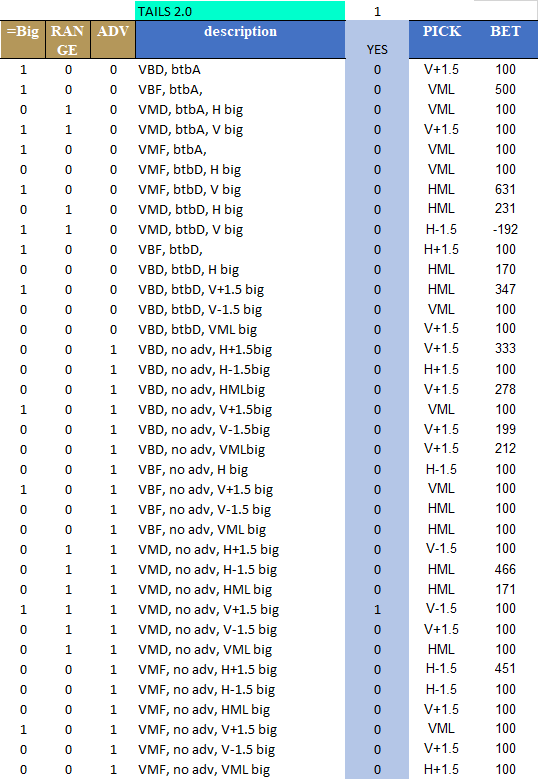

Explaining Tailing History 2.0

Tailing History received a massive makeover that produced a solid return for the first half of the season, but might have a weak foundation. It required getting a little too cute with conditions/permutations. My growing experience with model building is revealing that the more complex models are less likely to sustain over a larger sample (with a few exceptions). The more specific vectors with different conditions there are in your profit matrix, the less stable it will be (especially if they are individually small samples). We'll see, as I Tweeted back on Feb 3, I'm doubtful that Tails 2.0 will turn a profit for the 2nd half, but the original version had become completely useless. It’s on the leaderboard and now actively sharing picks.

The new version has roughly 40 different "game states", but the aforementioned sample size problem could make it vulnerable to collapse. Version 2.0 is much different than the original. It’s no longer a canary in the coal mine for historical replicability. That canary was a dead rotting corpse, such that the historical data has been removed from my previews. The new version doesn’t always bet on the side that produced a better return historically. It is simply built on “what was the best bet when VML, V+1.5, V-1.5, HML, H+1.5, or H-1.5 was more profitable historically”?

It took splitting the sample (half a season) into too many small groups to find profitable vectors, so this might be built on a house of cards. But so far, that house is still standing. The cerebral cortex below was applied to just the games that had already happened in the current season, so those 40 compartments have much smaller samples inside than 60 compartments for a 4000-game sample. I don’t mind sharing what the actual bets are, because nobody could re-create this without their own historical database.

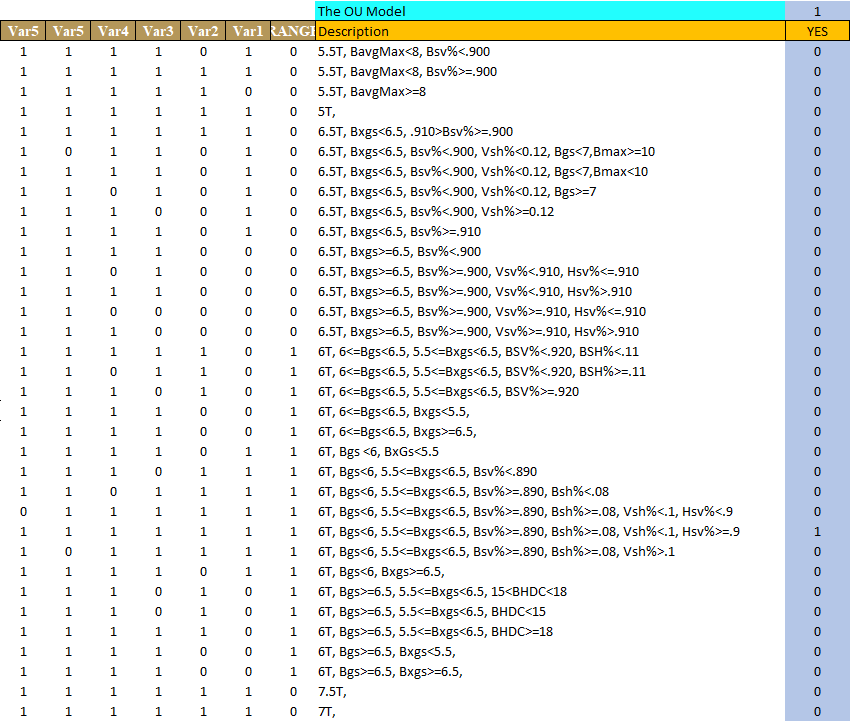

Introducing The Over/Under Model (clever name pending):

This one I’m just calling “The Model” because I’m not using anything remotely like it for OU. All my over/under advice comes from relatively simple formulas. They aren’t “betting models” by the truest sense of the word, so I decided to apply my evolving skills as a model builder (which is a work in progress, but subscriptions are free so bear with me) to actually build an “over/under model” that bets “situations”.

Step 1 was assembling a bunch of statistics for each team’s last 5 games: goals, expected goals, shots, save %, shooting %, high danger scoring chances, etc (which are already in my daily tracking, and yes, there was one sub-group that had to be divided by high danger chances). I have recorded all the over/under lines (both sides but not alternative totals) for roughly the last 3,500 games. Reduce that to games where each team had already played at least 5, then group them by the total (I tend to record very close to opening on Draft Kings). Take all the 6.5 totals for example, and start sorting stats looking for profitable angles: like combined save % below .890 and combined shooting % above 12%; bet max on the over.

Then continue adding variables until every single game belongs to a vector that generated profit (there were two groups that posted a tiny loss, but profitable paths had been fully exhausted) because the mandate is to make a pick for every game. My Small Council never abstains. Below is the cerebral cortex minus the actual bets. It should be noted that it doesn’t always bet the side you’d think based on the descriptors, so be careful if you attempt to reverse engineer this one. Note in the image, the “B” stands for both teams, generally an average of the two teams. This model recorded wagers for most of the last 3 seasons and generated an 8% return, which is better than my historical OU average.

Note that it bets max on the under every time the total is 7 or 7.5. There was no angle I could extract which generated a profit on over 7 goals across all 3 seasons. I even tried > 13% shooting % and less than .890 SV%, but it still wanted to bet under.

Looking At The Week Ahead:

This was a catastrophically bad week for my previously beloved Max Profit model, so until that turns around the picks won’t be shared in my graphics. What’s interesting is the slump started very close to when the original versions of Tailing History and Betting Venues (which had been awful) were upgraded to more competent versions. It’s entirely plausible that having active awful models contributing to the profit-loss data was important to MP’s success than everyone being decent. Nearly all that loss came on moneylines, earning down around 50 cents on the dollar for both favorites and underdog MLs. That’s generally a sign that a model is broken. Stay tuned, Maximus might be going into the shop for repairs.

Also, Shorting Goalies has now moved into the lead for my 2nd half model tournament. The pick graphics below will have models ranked from best to worst by Q3 ranks, except that Shorting Tavel is going on the bottom because it abstains from most games, but has slowly been heating up (historically it works best in the 1st and 4th quarters). The Hedge Fund Composite model had a healthy rebound after being disconnected from “Goalies vs Teams, which was deleted in favor of Game Sum 2.0. My Weighted Wins 2.0 model was fit to a large sample, but has been really bad since being automated, so I’ll have to run a diagnostic if that continues. Maybe that was human error. I’m not immune. There’s a lot of moving parts to this operation.

Tomorrow’s Picks:

Here are my picks for Monday. If you are new here and don’t know how the rest of the models work, there’s a link for that (which I’m updating today with the explanations posted above).

SEA @ NJ:

Both these teams have only won 3 of their last 10 games, so neither really deserves a heavy dose of confidence regardless of which side you choose to bet. My models are going overwhelmingly New Jersey, mostly ML, so that’s going to be my pick at -162 (it has moved to -155). Jack Hughes has only been back with the Devils for 2 games (scoring no PTS on 11 shots with a -3), and they’ll be dangerous whenever he inevitably gets rolling. Not sure if that would be tomorrow, but in the meantime, Vitek Vanecek is suddenly sporting a .915 SV% in the last 30 days, which is going to hurt their overs if that persists (he also joined one of my fantasy teams). That’s already been happening, as my new OU model is performing terribly both betting over and under 6.5 with either of these teams in the last 30 days. The Small Council is taking the under, and I’ll tail with a minimum bet.

CGY @ NYR:

This game is a quagmire. The Flames have won 3 games in a row since trading Elias Lindholm, thanks largely to the outstanding play of Jacob Markstrom. He is rumoured to be part of trade discussions, so if that piece is removed, that’s when the floodgates should open. Especially if Tanev and Hanifin are also moved. In the meantime, be careful betting Calgary to lose. The problem is that Markstrom has started 6 games in a row, so the back-up is due for a start. Maybe because it’s the Rangers in New York, they won’t start the rookie back-up (Vladar went on IR). I’m not terribly confident in the Rangers to win or lose either.

Shesterkin has an .889 SV% last 30 days while Jonathan Quick is .931. Both those number could reverse at a moment’s notice. I’ll take the Rangers ML -162 hoping that Calgary finally implodes from the loss of Lindholm, and that this is Quick vs Wolf. It’s a little unnerving that most of my models taking HML are not doing well with that pick and these teams last 30 days. Rangers lost 4 of 5 before winning 4 straight. I’m also taking under 6 goals, which only passed with a 3-2 vote. Jeez, The Model is struggling with this bet last 30 days too. It might need safety protocols.

ARI @ PHI:

Whatever Samuel Ersson did over the all-star break should be transcribed into an instruction manual for goalies struggling entering a break and how they can snap out of it on fire. He has stopped 48 of his last 50 shots and Philly has won 3-straight (beating some tough competition in Winnipeg and Florida). On the other side, the Arizona Coyotes appear to be trending in the opposite direction, losing 5 consecutive games, mostly on the road. All that makes me feel good about picking the Flyers ML -148, which is the largest position my models are taking (though 34% of their investment is on Arizona -1.5 goals). I’m going to take over 5.5 goals in yet another 3-2 vote by the council.

MIN @ VEG:

My animal instincts upon seeing this game felt compelled to bet Vegas to win at home, Minnesota losing on the road. If you followed that strategy for most of the last 5 seasons, you would have done pretty well (technically betting Minnesota to lose every road game since October 2019 would have led to a $775 loss on 178 wagers, but betting them to win all their road games would have led to a larger loss). My instinct to take Vegas lost steam upon seeing that 38% of my model investment is Min ML at +136 (which has moved to +124). 52% of the total model money is on Vegas, but I like the 38% number on an underdog ML better. I really like under 6 goals. The Model took the over, and yet again is losing money on that bet with these teams last 30 days. Keep in mind the other Small Council members always bet the minimum amount, but The Model has a max that’s up to triple the minimum.