The first half of the 2023/24 season is in the history books, so let’s review what worked and what failed in the 2nd quarter (henceforth referred to as Q2). This period of the season began on November 27th and is primarily identified as the “holiday season” taking place mostly in December when days are darkest and coldest. Though if you think that those specific circumstances means that history is likely to repeat in a manner similar to the last two Decembers, you would be mistaken. My Tailing History model (aka Tails) was designed to track historical replicability, the proverbial canary in my coal mine, to let me know if the data in my weekly previews is actionable. Tails had a good first quarter, then collapsed in Q2.

Before we go any further, it’s time for my obligatory *DISCLAIMER* it needs be noted that I’m not betting with real money. These are all fictional wagers in a spreadsheet. My mission is to engage in a mass betting campaign, picking a winner of every single game, every over/under, because it provides a complete dataset for macroeconomic analysis, which can be shared with you, shedding light on what worked and what failed. I’m also tracking the results of betting every outcome, to help me (and you) uncover previously unknown or newly emerging profit vectors. What started as a thought experiment has evolved into much more.

Tails wasn’t my only model to suffer a substantial setback as the calendar rolled over to December, as the previously mighty “Betting Venues” endured the same problem. It built up a big bank roll making large, fearless bets on pucklines -1.5 goals (especially underdogs). One key feature of December 2023, it was a bad month to bet anyone -1.5 goals. If you bet $100 on every team to win by -1.5 goals every game (yes, that would involve betting both sides of each game, but humour me), you would have lost roughly $11,000, with dogs losing approximately $7,000 and favorites $4,000. I’m not sure if that’s attributable to worsening empty net goal accuracy, or more games tied late in the 3rd period.

The new star on the block among my betting model harem is “Max Profit” (aka Maximus, formerly known as Megatron), who got off to a rocky start when initially trained on the other models input data, but took off once I changed that to totalling their profit. Hopefully no Transformers fans were upset by the name change, but all the other models have a name that explains what they do. Max Profit was perfect. The last one to join the team was the “Grand Aggregator” who just adds up everyone’s picks and bets the largest position. But it was easy to make picks for that one going back to Dec 3, and it performed very well. For a full explanation of all the models, click here.

My recent discovery that it might be more profitable to bet against so-called “line value” inspired several hours of introspection. If the numbers say a line should be +120 and it is +160, my thought has always been that I’m getting $40 of value on a $100 bet. The title of my betting book was very nearly “The Quest For Value”. It had never occurred to me that “value” could possibly be a bad thing. This spawned the creation of a “Hedge Fund” betting negative value, but the whole concept is new to me and much processing needs to be resolved before any big picture takeaways can be shared. Hopefully that will be the theme of my Q3 report.

The Hedge Fund member that you’ll be seeing most often going forward is also the President of the organization, the composite score that just adds up what the members are betting. Three of the five members bet against “line value” so they need to see a line before making pick, taking what they deem the most expensive. If a team should be -150 and the line is -250, I would mostly bet the underdog getting turned off that price. But maybe the question I should have been asking is why. What do the books know that I don’t? The downside is, the process of absorbing this concept is breaking my brain. I’m suddenly suspicious of lines that look too good to be true.

I’m off to a bad start in the 3rd quarter. The all-star break is nearly here, and I’ll be taking that opportunity to study my models and figure out everyone’s strengths and weaknesses, setting up guidelines to follow when making picks. I like my new advisory team, but most of them are new to me. Nine of them were born after Christmas (two of those existed previously but were flipped upside down), but their picks could be retroactively applied to games that had already happened, and they performed well in that sample. But several of those were also trained only on that sample, and if there’s a shift in what parameters are profitable, they’re screwed. They weren’t trained on a comfortably large sample (except Shorting Value and Weighted Wins).

Some of you might not be familiar with the model who finished on top of my Q2 model rankings, or at least what it became. The initial version of Goalies vs Teams added up the betting results for each probable starter in the last 4 seasons when playing against this team (not caring about home or road splits). It proved to be spectacularly awful. Then when it was flipped upside down, it was awesome. But I’m not expecting that to sustain so am not sharing the picks (week 2 of Q3 it is in dead last and dragging the composite down with it). You’ll see Shorting Value in my team-by-team graphics, as that’s the one that produced a profit over the largest sample of games. Weighted Wins is the most sophisticated.

The rise and fall of Betting Venues is clearly visible in the chart above, but the fall ended right around the time inputs updated to include the current season. But just as it was starting to look like another big heater was brewing, what followed was another collapse resulting in a demotion to the bench. Fortunately, that second dive was happening just as Max Profit was ascending and my Hedge Fund was being born, providing capable replacements in the starting line-up. During the all-star break I’m going to test a few alternatives to the current model over a larger sample of games. An upgrade might be on the way, but the initial foray did not produce any immediately visible profit trends. I’ll have to dig a little deeper.

One thing that grew increasingly clear as Q2 was rolling along, there are more good teams in the NHL. Last year when everyone was tanking for Bedard, you can see those underdogs ML were a straight line own. Though favorites dominated even more in December 2021 than 2022. Dogs were better bets +1.5 goals (which did repeat in December 2023), but as you can see up in the favorites graphic, there’s a lot of variability -1.5 goals. The demographic can be very erratic, with good weeks and bad weeks mixed in. Those images should show you what Tails was betting, and when the previous seasons diverge the most, that’s when Tails sustained the most damage.

Over/Under

This has not been a good season for my over/under betting, but I’m hopeful for a strong second half with some of the newer models added to my advisory team in the last couple weeks. The Goalies Last 30 Days and Grand Aggregator models were not added to the tracking until after the graphic below was prepared and I’m running a tight schedule trying to get this all finished. Below is a graphic with overs vs unders for the current season, and the previous 2 added together. 90% of my picks were the same as my primary algorithm (aka Prime), but I’m not using a primary anymore. My 6 best performers will be aggregated into my selection, with bets scaled to how many agree. 3-3 bet minimum, 6-0 bet max.

The most damage inflicted on my over/under portfolio came when my primary algorithm (aka OU Prime) came online just as unders ended a hot streak, taking a mighty loss the next couple weeks, bringing me down with it. You can see how the shape of my profit line closely mirrors Prime, but once Maximus burst onto the scene, my choices began deviating more regularly, though not with great success. Another option would be just not placing a bet unless there’s substantial agreement among the models. That’s not my mandate and sometimes the best lessons learned are from money lost. Below is the Q2 leaderboard.

One thing that’s a little embarrassing is that I tailed my primary algorithm in at least 90% of games yet somehow managed to go 12-27 when disagreeing, which tended to be when there was a worrisome goalie coming up or the other models (notably Max Profit) really liked the opposite side. Maximus was the only one who could talk me out of the pick, and that was the best performing algorithm. It does strike me as strange that I was that bad when dissenting, but I’ll hope it’s just random variance rather than flawed intuition. Most of it came from lost overs, so perhaps I’m too paranoid about certain bad goalies? They don’t always get the start either.

Goalies

For a better idea of which goalies were to blame for my losses and acclaimed for my successes, check out my stat graphics below. There is not much discussion required here because goalies are addressed in my team sections. This was actually my first quarter trying to predict who the starter would be for each game, employing betting models that make picks based on those probabilities. There was a 90% correlation between my predictions and reality. That would have been higher if Colorado and Tampa weren’t running their starters into the ground. Interesting to note, Ilya Sorokin cracked my 5 worst goalies to bet on AND my 5 worst to bet against. If Islander fans want to bribe me to bet their opponents for the rest of the season, just Tweet at me.

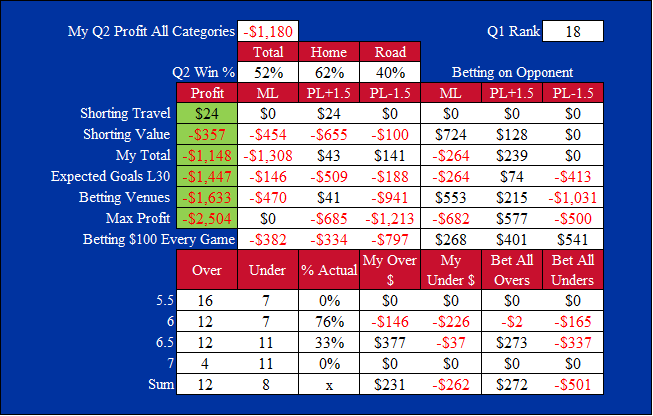

My 2nd Quarter Results:

Looking at the overall category leaderboard is depressing, because of all the several categories I’m tracking, only 3 turned a profit in Q2. Road dogs under +150 ML were profitable -1.5 goals, while road teams +1.5 and underdogs +1.5 turned a profit (there is overlap between those two). That means that oddsmakers did an effective job finding moneyline equilibrium between favorites and underdogs. Aside from that one subset, you can see what a killing field the quarter was -1.5 goals. My subscribers were aware of this in early December. I was warning people to lay off when they stopped cashing.

Unders went 173-166-11 in Q2. As you can see, just betting over 6 and under 6.5 every single game those were the total, you could have turned a healthy profit. That’s the primary reason Tailing History did well, as that’s the most common preference. There are a few weeks here and there when Tails bets under 6 and over 6.5, but mostly it’s just playing historical averages. That’s why Tails still has a seat on the Over Under Council (though, there was never an instance where Tails swayed my opinion on over/under, and I’m seeing it every game).

Below are the team leaderboards, and Vegas was my best team to bet against in Q2, but they strung together a winning streak at the beginning of Q3 that cost me a big chunk of those gains. Dallas also cracked my shorting leaderboard, but that was just the Scott Wedgewood administration with Oettinger on IR (the biggest gains coming when they also lost Heiskanen before Jake returned). This was a good quarter for me, but betting the Rangers to win was one costly strategy. It would have been better to bet them to lose every game. Yeah, they won more than half, but there was a lot of juice on those lines.

Team-by-Team Profitability Rankings

The team-by-team gambling Profitability Rankings (formerly known as Power Rankings) are ordered by the sum of all my bets on each team to win or lose, over or under for the entire season. They are my own personal power rankings, reflecting my own success picking the outcome of their games. These aren’t necessarily the best teams to bet on, as some were swung by a few instances of good luck or bad judgement. You’ll have to read the team summaries for a deeper understanding of the replicability.

It’s worth noting, the Colorado Avalanche were comfortably in first place 2 weeks into the 3rd quarter.

1) San Jose Sharks, ($3,050):

The San Jose Sharks were on top of my profitability rankings for most of the first half, initially by aggressively betting their opponents, then briefly boarding the bandwagon, then jumping off after the futility returned. It was their 6-3 victory in New Jersey 3 games into Q2 that put me on Sharks +1.5 goals, which went on a little hot streak. It wasn’t until a 6-2 loss against Colorado on Dec 17 that sent them reeling back to rock bottom. Unfortunately, I stayed on that wagon 3 games too long, but hit some nice payoffs after departing. They maintained their lead despite me sustaining a $37 loss in Q2, mostly because of their over/under. I managed to profit both betting the Sharks to win and lose. That’s always satisfying to see, even if it’s just a lil’ bit.

Kaapo Kahkonen was the better goalie, at least until the end of the quarter when he began sliding and Blackwood improved. There was very little difference in my own performance with these two, so this hasn’t been a team I’m labouring to figure out who is starting. What’s interesting is that my models collectively ran a $4,500 profit on Kaapo, but lost $7,500 on Blackwood. Betting Venues was the worst, which makes sense given this team is worse than past seasons (not that they were good before) betting way too much on them -1.5 goals (on both sides). Shorting Value did very well with this team, so if you see a good price (on either side) don’t be fooled. If it looks too good to be true, it probably is…

2) Colorado Avalanche, ($2,816):

There were a few bumps in the road in the Avs first quarter, but they finished Q1 winning 70% of their games. Q2 brought some regression, most especially on the road. They had road losses to Anaheim and Arizona in late November, leading to a string of 5 losses in 6 games, the last two of which were on home ice. Then they won a couple games, and lost a couple (including to Chicago). But the Chicago loss was a kick in the ass that lead them to win 5 of their next 6. Inconsistent goaltending became a problem, but Nathan MacKinnon catching fire helped overcome that deficiency. They are undefeated this season when I write “angry MacKinnon” in my game notes. Guy REALLY hates losing.

Alexandar Georgiev battled inconsistency, but mostly settled down as December rolled along, posting a .901 SV% and winning 12 of 18 starts. The problem was his back-up, as Ivan Prosvetov collapsed after a strong start to the season (he was even praised by goalie-guru Kevin Woodley on the PDOcast) before posting an .879 SV% in the second quarter. They need to be careful not to put too heavy a load on Georgiev because we are seeing some cracks under the pressure. The good news is that angry MacKinnon can often make up the difference, that’s why my performance was so good picking them to win.

3) Los Angeles Kings, ($2,716):

The Los Angeles Kings became a safety net of mine later in the first quarter as parity was starting to complicate the landscape. They were one of the few teams who felt reliable to bet. My game notes for their first Q2 game simply read “I love the Kings”, a match they regrettably lost to Washington, which did not deter me from betting LA for their next 8 games. It was their 3-game losing streak to the Islanders, Jets, and Rangers that finally injected some doubt into my outlook. Cam Talbot found his way onto both my fantasy teams, which only added fuel to my burgeoning fandom, but the workload clearly wore him down by the end of the half.

The Kings going from good to bad did trip up some of my models, especially Maximus. Even Betting Venues managed a substantial loss when betting Kings to lose and they lost 65% of their games (but were covering +1.5 often in their losing streak at the end of the half). That’s a problem considering LA was brutal for a significant portion of my historical sample, but are suddenly a Cup contender (well maybe not without better goaltending). Maybe they should have traded all that capital for Connor Hellebuyck instead of Pierre-Luc Dubois, who is looking like a giant bust. All things considered, given my enthusiastic love for this team as the quarter began and where it devolved, I’m lucky to have emerged from the shit-show with $516 profit (thanks to over/under).

4) Vegas Golden Knights, ($2,262):

The Vegas Golden Knights hit the ground running as the season began, showing no signs of a Stanley Cup hangover, ranking as one of the best teams to bet in October. But slowly as the season wore on, the hangover (and injuries) began creeping into the equation. They remained good on home ice, but completely collapsed on the road. One big reason for their reversal of fortune was missing their best goalie Adin Hill for most of the quarter, and Logan Thompson wasn’t up to the task when given a heavy workload. They went from one of my best teams to bet on, into one of my best teams to bet against. My performance betting this team improved as they declined, climbing from 10th to 4th in my rankings.

That collapse was great for Max Profit, who quickly pounced on that lucrative opportunity, which helped tip me off to this emerging trend. That injury situation worsened as the quarter closed, losing both Jack Eichel and William Karlsson, two very important pieces down the middle. I’ll need one or more of those back on the ice before I’m ready to trust this team. They did win 64% of their home games and 27% of their road games, so maybe take the foot off the gas on home ice if you’re aggressively betting them to lose (like me). Betting Venues was terrible with this team, but was betting far too much -1.5 goals (on both sides).

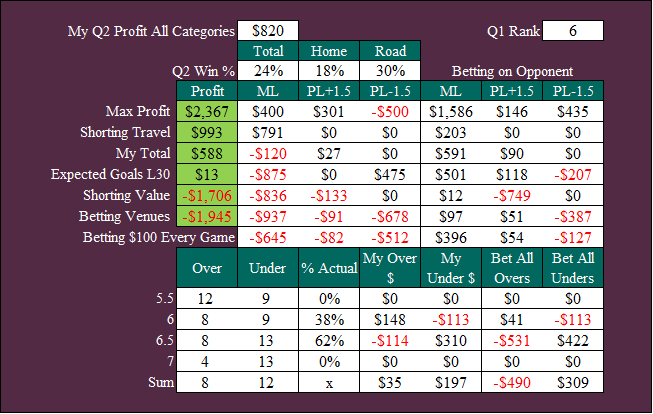

6) Anaheim Mighty Ducks, ($1,938):

The Ducks started the season strong but once the second quarter began, they were free-falling. My game note for their first Q2 game was “Ducks struggling”. At that point I had disembarked their bandwagon and was mostly betting them to lose. By the end of the quarter, 70% of my final investment was on Anaheim opponents, pulling a nice little profit in the process. While I did occasionally pick them +1.5 goals, that only produced $27 of profit, and their moneylines were a net loser. This was a team that only won 24% of their games, but if you bet $100 on all their opponents to win by -1.5 goals you lost $127. Max Profit mostly stuck to ML and crushed the quack attack.

Lukas Dostal struggled in the first half before emerging as the better goalie (Gibson has a history of struggling in the second quarter), posting a .920 Q2 SV% compared to Gibson’s .889. My results were certainly much better when Johnny got the nod, with most of the profit coming from over/under. I was up almost $600 on Gibson OU losing a little more than $300 on Dostal. What’s weird about that is that Gibson unders went 6-6, which Prime hit with remarkable accuracy. The problem was Dostal unders went 6-2-1, so those bad Gibby games were prompting Prime to bet over. My Goalies Last 30 Days OU algorithm wouldn’t have had that problem (unless I was bad at predicting their starters).

6) Minnesota Wild, ($1,905):

The Minnesota Wild struggled badly out of the starting gate, and I was quick to pounce (history repeating) then they fired their coach at the beginning of Q2, caught fire, and I was quick to pounce. Well, sort of. I stayed away for their early December west coast road trip and it paid off. Then shortly after returning home from that trip, my ticket aboard their bandwagon was purchased. But frankly it was more profitable when they were terrible, as elevating into the middle class doesn’t necessarily improve the betting outlook. Then the injury bug hit them hard, losing Gustavsson and Kaprizov on top of Brodin and Spurgeon. They didn’t have the depth to deal with that.

That’s when my performance betting them to lose improved, but Kaprizov only missed a week or so. They were one of the best teams for my Shorting Value model, so just be aware that if it feels like you are getting a great price on them (or their opponent), maybe you’re not. I’m still new to the concept of betting against value, but as my Hedge Fund builds up more data, the phenomenon should become clearer. They were also one of the better teams for my Expected Goals L30 model, but a big share of the profit came from betting them to lose. Frankly this is also my first quarter with a functional in-season expected goals model, so I’m still learning the strengths and weaknesses.

7) Vancouver Canucks, ($1,901):

The Canucks finished the first quarter #1 on my profit list when betting a team to win (LA was #2), after their convincing wins against Edmonton to start the schedule lured me onto the bandwagon early. I live in Vancouver, so all their games are on my TV. Frankly it would be embarrassing if this wasn’t one of my better teams to figure out (they are #4 on my all-time profitability rankings behind Tampa, Florida, and San Jose). My game note for their 2nd game of Q2 was “Canucks slipping”, which did lead me to a temporary crises of faith, but eventually they sucked me back in. Casey DeSmith actually outperformed Demko (albeit against easier opponents) posting a .931 SV% to Demko’s .913.

By the end of the quarter, Vancouver sat in sole possession of first place in the entire NHL. That’s not something I saw coming prior to the season, but embracing their ascension was lucrative. The fact this is a much better team than previous seasons means Betting Venues really struggled picking them to lose because they improved. Picking Canucks to lose was also a big loser for my Hedge Fund, so this was a team where seeing value on their lines was a good thing. Frankly I’m a little surprise there was “value” on Van lines because this felt like a “public” team in December that would have been taxed. Maybe this just feels like a public team to me because I live here.

8) Dallas Stars, ($1,608):

After walking out of Q1 with $94 profit betting Dallas outcomes, my performance gambling this team improved in Q2. They were without Jake Oettinger for a chunk of the quarter, though Jake had been struggling prior to visiting IR and Scott Wedgewood struggled in his absence. That helped me win some money betting them to lose, especially after Miro Heiskanen was also lost to injury. It’s hard for me to love this team when Miro is out of the line-up. For the most part I’m a Dallas believer, but I need a healthy Heiskanen and a sharp Jake Oettinger to maximize my faith (both were back in the line-up shortly before this was posted).

My profit betting Dallas wins and losses exceeded my top models, enjoying significant success both when betting them to win and lose. I’m a little confused how Maximus bet that much money on Stars to lose by at least 2 goals, when few of my models excelled betting Dallas to lose by -1.5. More than half that money came from 2 games in St Louis that the Blues won, but only by 1 goal. Though several of my models were either completely flipped or deleted entirely since those games were played, so perhaps Maximus was led astray by those losers. That being said, my models collectively lost $2,500 on Scott Wedgewood starts.

9) Florida Panthers, ($1,489):

The Florida Panthers had to play most of the first quarter without their best two defensemen, and still won 60% of their games. Once healthy, they really started rolling. My game note for their 3rd Q2 game noted “Florida is really good”, betting them in 7 of their first 9 Q2 games. Then there was a late-December stretch (just was a new winning streak was forming) that I picked their opponents 4 times in 5 games, getting out of it unscathed because they were only tiny bets and I was hitting the over/unders (I got cute, listened to some models, you know how that goes). They played a road-heavy Q2 schedule, and typically they’re worse on the road, but not this time.

The strength of my Panthers quarter came down to unders. Both goalies played well, so there was no need to worry about a shaky back-up. The biggest concern as the quarter came to a close was the injury status of their best player Aleksander Barkov, who is having a dominant season, but has missed games with a nagging injury. That should explain why they abruptly went from a 9-game winning streak to a 4-game losing streak. Bobrovsky posted a .916 SV%, Stolarz .928. Strong goaltending and a high-octane offense are a winning combination. Florida had the second best expected goals differential in the quarter, but my Expected Goals L30 model struggled -1.5 goals when they were among the better teams covering -1.5. That might warrant an investigation.

10) Seattle Kraken, ($1,479):

After earning respect last playoffs by upsetting the Stanley Cup champions, Seattle took a step backwards after a big step forwards. Whatever agreement Phillip Grubauer made with Satan to upset Colorado in round one last spring has clearly expired as he missed most of the quarter with an injury (after a bad Q1). The team only won 36% of their Q1 games, same % home and road. This was trending into a lost season until Joey Daccord was unleashed from the ashes to save their souls. Sorry, I don’t know how I got onto this religion angle. They had a six game homestand where I bet their opponents 5 times. By the time they left on their next road trip, I was betting them almost every game.

In retrospect, saying Phil shared Satan’s contact info with Joey is probably a funnier joke. Daccord won 10 of 14 games with an incredible .944 SV%. The Kraken won their last 9 games of the quarter, and once I jumped on the bandwagon, they shot up my profitability ranks. Max Profit took a big loss early in that winning streak, but eventually got on the right side of history. Shorting Value handled this team well, especially betting them to win, meaning the perceived value during that streak was on the opposition. Oddsmakers didn’t want you betting the Kraken, so they may have added a little extra juice to try and lure you to the other side. My Hedge Fund saw through that possible deception.

11) Tampa Bay Lightning, ($1,261):

The Tampa Bay Lightning lost more than half their games in the first quarter, spent mostly without their star goalie. Then Vasilevskiy returned in late November, immediately took on a heavy workload (they played 14 games in December), and spent all of Q2 mired in mediocrity. Hard to say if a few extra days rest would have improved his starts, but I’m sure he was insisting on playing all those games and wasn’t going to take no for an answer. This is a guy who refuses to get pulled from blowouts. It feels like if Nikita Kucherov had missed this entire season with an injury, Tampa would be challenging for the first overall pick in the draft.

The secret sauce with this team is bet them to win at home and lose on the road. That simple strategy is why they are #1 in my all-time profit rankings, and Q2 was no different. They won 73% of their home games and 33% of their road games. Hence why all my models who care about home and road records turned a profit betting their games. What concerns me going forward is the load on Vasilevskiy (who no doubt is telling the coach he wants to play every game), going 2-3 weeks between games off. He’s 29 with a surgically repaired back. Perhaps the most worrying aspect is that he started 20 of 23 games, winning 11, posting a below average .897 SV%. Yeah, that’s better than Jonas Johansson, but that’s not a Vezina caliber goalie.

12) Winnipeg Jets, ($836):

The Jets vastly exceeded my expectations in the first quarter, but they’re among my favorite teams, so it didn’t take me long to hop aboard the metaphorical wagon (don’t worry, my bandwagon references will be ending shortly). But my Jets love came to a crashing halt when the lost Kyle Connor to injury on December 10th. That led to an instantaneous departure from the aforementioned wagon, but something strange and unexpected happened. The Jets kept winning (losses to San Jose and Montreal notwithstanding) and eventually their siren song lured me back aboard. While they excelled without Connor, losing Mark Scheifele as the quarter closed cost me two large wagers that plunged them down my ranks.

Connor was nearing return as the quarter closed, and I’m planning to keep my foot on the gas. They won 73% of their Q2 games, I bet them to win most of the time, yet still walked away with a net loss betting those wins. The backbone of this team was the goaltending (with a little help from the defense), with Hellebuyck posting a .939 SV% and Brossoit an extraordinary .952 (he does tend to get the weaker opponents). That’s also why their unders went 15-5, leading to a nice profit for me. As much as I’m enjoying the renaissance they are experiencing, it also wouldn’t shock me if they began to struggle in the second half, but I’ll need to see it happen before departing the bandwagon becomes a necessity once again.

13) Boston Bruins, ($623):

The Boston Bruins were among the NHL’s best teams in the first quarter, but cooled in December before heating up again in January. During that little cold stretch, their previously impenetrable defense began showing cracks, as Jeremy Swayman took his name out of the Vezina race (he did bounce back). There was a stretch of 4 games where I exclusively bet Boston opponents, though my game notes didn’t fault the Bruins for that streak and I was on Boston in 5 of the next 6 games. My Bruins Q2 was decent, but the same can’t be said for my betting models. Well, except the Hedge Fund, which pulled profit from both sides, meaning that so-called “value” was misleading when informing your betting decisions.

Having watched a few of their games, Pastrnak is the key to this team, a game-breaker who is a threat to score every time he’s on the ice. Marchand is still pretty good, but he’s better as a compliment to Pasta than he is trying to drive his own line. Yet this is supposed to be one of the league’s best teams and they only won half their Q2 games, so don’t get fooled into thinking these are the same Bruins as last year. Though, Spittin’ Chiclets is spreading rumours that Patrice Bergeron is skating in Boston to keep in shape, which was spun into irrational optimism about a possible return. It’s not impossible, but until that day comes, I’m not influenced by any illusions that this is the same team from their glory days.

14) New York Islanders, ($616):

The Islanders cracked my top 10 most profitable teams in the first quarter, with most of the revenue generated from betting their opponents. The Isles only won 40% of their Q1 games and were better on the road than at home, probably because their fans are uncivilized maniacs. My models struggled with this team in both quarters, and one of the issues was a full reversal on home ice (which could also be because their fans are uncivilized maniacs), while getting worse on the road. Any model (or bettor) using Q1 patterns to make Q2 picks with this team ran into issues when they reversed course, though Shorting Value managed to navigate the storm without issue, and Shorting Travel did well betting them to lose.

In some of my Q2 picks pieces, I lamented the Islanders making me feel embarrassed about my picks whether betting them to win or lose. It was decidedly worse on the games that I was sharing in my reports/emails, feeling like my picks had the ability to influence the game. Given some of my experiences with Islander fans on Twitter, I’m tempted to pick them every game in the 2nd half just to torpedo their season. They won 50% of their Q2 games, which is the very definition of “mid”. What’s bizarre about their middling performance is getting average goaltending, but above average scoring. That’s not what we are accustomed to seeing from this team. Their overs went 16-5. Without looking it up, I’m comfortable saying that’s the most overs they hit in a quarter since Oct 2019. At the start of Q3, they fired their coach, and Roy doesn’t appear to be bumping up their output.

15) Ottawa Senators, ($542):

My betting models had a strong first quarter picking Ottawa outcomes, and the good times continued rolling, well not for the team anyway. They went from winning half their Q1 games to contending for Celebrini at the end of Q2. I did quite well picking their wins and losses, but their over/under proved to be an enigma. They fired their head coach mid-December, but did not get the desired “new coach bump”. By all accounts they loved the outgoing coach and were battling to save his job. There wasn’t going to be a motivational bump, and even if Jacques Martin can fix the structural problems, that wasn’t going to be immediate. Doing a proper quantitative analysis on team performance after coach firings is on my offseason “to do” list.

Reviewing my Senators game notes, there was a lot of model tailing. It was hard for me to trust this team to win or lose, but their losses were certainly more lucrative. The big story for this team is that year one of Joonas Korpisalo has been a disaster, posting an .868 SV% in the quarter. Anton Forsberg was playing better (.910 Q2 SV%), but was lost to injury prior to the quarter’s end. This was a good team for Betting Venues, as Ottawa sucking was also reality when many of those games were played in previous seasons. Certainly, any model betting them to lose on the road and win at home would have done well. At the time I’m writing this, there are rumours they’re trying to trade Chychrun, Tarasenko, and anything else that’s not nailed down.

16) Nashville Predators, ($495):

The Nashville Predators entered the second quarter on fire (my game notes say so) but one complication from a betting point of view was their excellence on the road and struggles on home ice. Fortunately, I wasn’t playing a home-road angle with this team, and was picking them to win most of their games, which was a net positive, improving my Preds performance from the first quarter. Juuse Saros was on fire early in Q2, but did start to cool around Christmas time, just as he was acquired by one of my fantasy teams. I’ll be painfully (or blissfully) aware how good or bad he may be in the second half. He finished the quarter with a .903 SV%, but Lankinen wasn’t any better at .886.

I’m not expecting those home-road splits to sustain, but it’s something to keep in mind when you’re betting this team. Even if both those regress back to the mean, there’s still undisputable evidence they’re a good road team. Their “goalie of the future” Yaroslav Askarov started one game with a .943 SV%, but it’s unlikely he’ll get a roster spot without an injury or trade. There are rumours they might be trying to move Saros, who only has one year left on his contract. This was an awful team for Betting Venues, so if you see a stat that they’re good or bad in a venue against that opponent, don’t let it sway your opinion. Meanwhile, this was one of the best teams for my Hedge Fund, so if you think you’re getting “value” on a line, don’t believe that either…

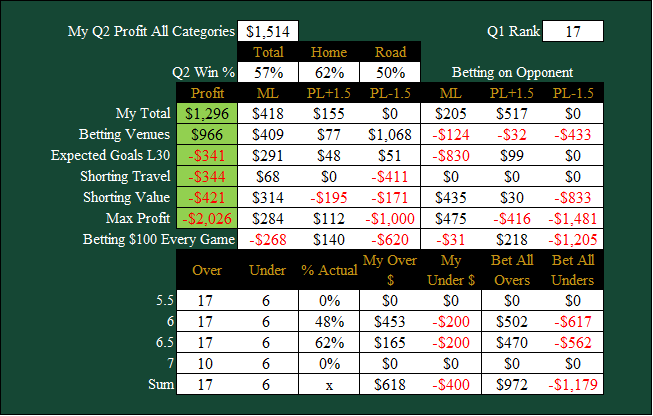

17) Arizona Coyotes, ($400):

The Arizona Coyotes are a better team than last season when they unsuccessfully tanked for Bedard, but it would seem management has begun to acknowledge if they don’t put a winning product on the ice soon, they might be forced to leave Arizona before construction even begins on a new building. They exceeded expectations in Mullett Arena last season when there were very generous prices on their lines. But once word got out they were good at home and a better team in general, line prices grew much more expensive. They played a very home-heavy Q2 schedule, and were bad on the road.

Karel Vejmelka was awful in the first quarter, but did manage to turn that around, or at least stop the bleeding with a .901 Q2 SV% (he resumed sucking once Q3 began). Connor Ingram emerged as the #1 guy (acquired by one of my fantasy teams), posting a .919 SV% and winning 8 of 14 starts. All my betting success came with Ingram in goal, posting a net loss on Vejmelka starts. My betting models certainly thrived in Ingram starts, while my Shorting Goalies model struggled with Vejmelka specifically. That team sucked for his first 2 seasons when he played often and it was profitable to bet him to lose. Because they bet “opposite” of past success, they laid way too much on him to win, which was a bad investment. Ingram unders went 7-4, Vejmelka overs went 5-2. Note to self.

18) St. Louis Blues, ($243):

The St. Louis Blues were among the best teams for my Betting Venues model in Q1, and that success continued in Q2 when the rest of my models struggled to get a read on this team. They’re one of those “can beat anybody or lose to anybody” types, but their performance in individual venues had a strong correlation to past performance in those buildings. Note to self. Sadly for my Tailing History model, the Blues were not very replicable in terms of historically profitable line ranges. That instability isn’t surprising given their erratic goaltender and talented forwards. Binnington can win or lose games on his own, and they can score.

Binnington had a few bad games in the quarter, but some strong games too, settling at a .903 Q2 SV%. The team started using Joel Hofer more often, who posted a respectable .910 SV% and my performance was better with him in goal. They fired head coach Craig Berube on Dec 13 and did win 5 of the next 6 games, but that’s as long as the bump sustained, as they lost 6 of their next 9. This team might have bigger problems than the coach, but they’re hard to trust whether you are betting them to win or lose. Finding the right balance was a struggle for me in the 2nd quarter, losing $239, but my picks tend to be small given the unpredictability of outcomes.

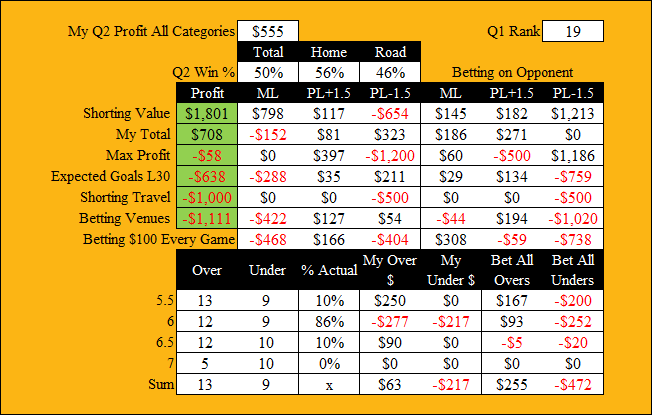

19) Carolina Hurricanes, (-$118):

The Carolina Hurricanes was among the best Q1 teams for my Tailing History model, as they were remarkably obedient to historical precedence. That did not carry over to the second quarter, when they improved on the road but grew much worse on home ice, winning 55% of their games. That had devastating consequences for Betting Venues, who is accustomed to storm surges. For all my model struggles, my own performance wasn’t bad, but it wasn’t exactly good either. There was a healthy mix of optimism and pessimism (my game notes for their Dec 21 Penguins game simple read “I hate both teams), finishing close to even betting them to win and lose.

Much of that unpredictability is directly correlated to goal prevention, with Antti Raanta playing brutal hockey early in quarter, enough that he was sent to minors and cleared waivers with no buyers. Kochetkov improved from Q1, posting a .907 SV% in Q2 and winning 9 of 16 starts (Raanta won 2 of 6). Koch did sustain a concussion near the quarter’s end, and Raanta was no longer terrible after coming back up and taking over the job. Still, as of January 18th they were only 3 points ahead of Washington who sat 9th in the Conference. At the beginning of Q3, they were one losing streak away from falling out of a playoff spot. This is not the dominant Carolina team from last season.

20) Pittsburgh Penguins, (-$324):

My sense of the Pittsburgh Penguins in the first half is some nights they play like one of the best teams in the league, other nights they suck, and on the whole are middling at best. Last quarter they were better on the road, but that flipped in December. Last quarter Betting Venues was my only model that pulled a profit from this team, and in Q2 that was Tailing History. Not a good model team overall, which includes my Expected Goals model. This team is hard to trust whether you are betting them to win or lose, and teams like that are a potential minefield. Reviewing my game notes, there was ample complaining, indecision, and that aforementioned “I hate both teams”.

There was not much difference between the goaltenders in terms of SV% (.907 vs .908) or GAA (2.81 vs 2.75) but Nedeljkovic won 6 of 9 games while Jarry only won 4 of 12. Tristan Jarry had been on one of my fantasy teams before getting traded in a deal for Juuse Saros. The back-up eating his lunch more often was the driving impetus for the offer. I’m not exactly sure what the problem is with this team, Crosby is playing great, they look much better on paper, but it’s not translating on the ice. Karlsson isn’t the same guy as last season, but he’s still scoring at a respectable 60-point pace. This was a very good team for my Hedge Fund, so perhaps my strategy going forward should be shorting line value.

21) Montreal Canadiens, (-$580):

The Montreal Canadiens were dead last in my profitability ranks as the first quarter closed, and once that chapter of history was shut forever, so too did my Habs woes end. They were basically the same team in terms of winning percentage (hovering in the low 40s), but this quarter they were better on the road. The biggest factor behind my abrupt course reversal was over/under, going from terrible (on both overs and unders) to awesome (on both overs and unders). Maybe this summer I’ll schedule a diagnostic to figure out how exactly how this happened, but they went from unpredictable to predictable. Had the reversal been in the opposite direction, I’d be more concerned about Q3.

This team has been using a 3-headed monster in goal, but they were all competent in Q2. Jake Allen was slightly below competent (.893 SV%) winning only 1 of 5 starts, making him my best goalie to bet on this team (pulling $887 profit in those 5 games). If I’m betting them to win, Montembeault is the preferred choice and they’re pretty good about declaring their starter earlier than most teams. It’s just challenging trying to predict who the starter will be. This was a bad team for Shorting Value, both when betting them to win and lose. Though it’s too soon for me to say if value-based betting is consistent quarter-to-quarter at the team level. Value is relative to prices books charge.

22) New Jersey Devils, (-$634):

The New Jersey Devils lost 53% of their Q1 games, thanks in part to a stretch of games without Jack Hughes and Nico Hischier. With both healthy in the next quarter, they were a much better team, though were dealt a significant blow with a Dougie Hamilton injury (shocker). Hughes suffered another injury late in the quarter and missed significant time. My biggest problem with this team was over/under, getting destroyed on both overs and under (NJ overs went 13-4 in Q1, but they adjusted the lines to neuter that in Q2). The goaltending continued to be a significant problem, but at least transitioned from really bad to slightly bad.

Akira Schmid was demoted to the AHL while Vitek Vanecek was awful with an .878 Q2 SV%. They recalled Nico Daws late in the quarter and he won 3 of 4 starts with a .916 SV%, providing a brief glimmer of hope but my quasi-professional opinion is that they need to trade for a goalie, which should have happened back in the summer. You can fire Lindy Ruff (which has been trending lately) but he can’t stop hockey pucks. Granted, they said that about Jay Woodcroft in Edmonton and now Stuart Skinner is the best goalie in the NHL. It’s worth noting that this was one of the best teams for my Expected Goals model, which doesn’t care about goalie quality.

23) Calgary Flames, (-$737):

My problem with the Calgary Flames in the first quarter was betting too much money on them to win when they only won 38% of their games. My models performed very well betting this team (especially Betting Venues), but I didn’t actually know how well B.V was doing until compiling my quarterly report. A big chunk of that success was predicated on Calgary losing to teams by 2+ goals, especially underdogs. That opportunity closed as their play improved to middling, which increased the difficulty, as it was hard to trust your pick whether it was for a win or a loss. They seem at the precipice of a full teardown and rebuild, but also seem determined to make this work.

Players want out of town and they have some key pending free agents. If they sell Hanifin and Lindholm, this could be a rough second half. Yet in their current form they are winning more than they are losing, and have been a cash cow for at least 2 of my models. This was one of the best teams for Shorting Value, producing a substantial profit both when betting them to win or lose. Jacob Markstrom was their best goalie, winning 8 of 12 games with a .926 Q2 SV%, while both Vladar and Wolf lost more than they won and posted sub .900 save percentages. Markstrom was battling the injury bug as the quarter closed, so monitor that if you’re betting them to win.

24) Buffalo Sabres, (-$836):

Many expected the Buffalo Sabres to continue their upward trajectory and move into the playoff conversation, but perhaps too much of that optimism was built on the back of a rookie goalie. Devon Levi struggled to find consistency, but was better after a brief stint in the AHL. They entered the quarter without their best forward Tage Thompson, and I mostly bet their opponents in his absence. Upon his return I started betting them to win more often, though looking at my game notes, most of my reasoning for taking the Sabres was a comment about their opponent. Once they were getting regularly priced as underdogs, they became a more appealing pick.

Once Q3 was underway, Ukko-Pekka Luukkonen was heating up and delivering more wins. Levi actually had a better Q2 SV% thanks to a strong beginning of the quarter (slipping as it wore on). This was actually one of the best team for my Shorting Goalie models, but that’s surely due to substantial variability in goalie performance. They both seem to be alternating back and forth between good and bad. Consistency isn’t good if you’re betting the opposite of past performance, but it was great in the case of Buffalo. No idea if that’s sustainable. UPL could just be good in the second half. My Sabres Q2 was really good, but some of that was tailing my models who excelled with this team.

25) Toronto Maple Leafs, (-$1,011):

My models enjoyed significant success betting Leafs games first quarter, but that completely collapsed in Q2. Though strangely enough, as my models suffered a collapse, my own performance improved (from bad to decent). The goaltending became a big question mark when Joseph Woll was injured and Ilya Samsonov couldn’t stop a beach ball. Thankfully willy veteran Martin Jones was recalled from the AHL and found his way onto both my fantasy teams (he has since been dropped from both). It’s hard for me as a Leafs hater to own stock in a Leafs goalie, requiring me to cheer for their victories. While my output improved, most of that was before Jones stole the net. With him as the guy, my performance dropped.

Woll had a .932 SV% in 4 starts, Martin Jones .924 in 12 starts, Samsonov .834 in 6 starts. Needless to say, I tried to selling my Martin Jones stock while it was high, but evidently was too late. There’s almost no chance Jones sustains that high level, as he faded last year in Seattle after a hot start. We’ve seen this movie before. Is Woll the guy? Is Samsonov salvageable? (Samsonov has consecutive quality starts as of this getting posted) Father Time will let us know, but my big profit betting their unders in Q2 does not feel sustainable. After a month of Jones playing well, I’m still expecting the chariot to turn into a pumpkin at any moment. I have too much history with this guy (note that already seems to have happened, and most of this write-up was written before that (just take my word that I predicted the decline)).

26) Detroit Red Wings, (-$1,039):

Sometimes my bias as a Red Wings fan gets in the way of my betting performance, but the last 2 years it was my pessimism that did the most damage. I’m still cheering for this team to get a game changing forward in the draft, though Stevie seems perfectly capable of acquiring them through trades and free agency. Irrational optimism hasn’t been my problem. This quarter would have been a rough ride for Detroit had it not been for the emergence of Alex Lyon as a reliable starting goalie, though he did miss time with injury. Another important piece who missed time was Dylan Larkin, but the addition of Patick Kane helped offset that loss.

Then Kane was injured himself, but with a healthy Larkin and Lyon the Wings were officially hot as Q3 was underway. Lyon won 7 of 11 with a .915 SV%, Husso 2 of 6 with a .900, and Reimer 2 of 5 with an .873. You wanted Lyon in net if you were betting this team to win. I actually did very well picking their wins and losses (trying not to let myself be overcome with positive or negative feelings) but was destroyed on their over/under. When the total was 6.5, I was terrible (whether betting over or under, but mostly under). This might require checking which of my over/under algorithms handled Detroit the best and using that one for their games.

27) New York Rangers, (-$1,094):

The Rangers were among the best teams in the entire NHL first quarter, but it’s easier to win games when you’re getting great goaltending. Igor Shesterkin was decidedly average and almost surely took himself out of the Vezina trophy conversation (if he was ever really in it). The team was especially bad whenever I had big bets on them to win, but were often outstanding when I picked their opponents. It was mentioned in my Q1 report that this was one of my “butterfly effect” teams last season, so this is a continuation of an exiting trend, not a newly emerging development. I’ve struggled with them before, and a shaky Shesterkin doesn’t help.

Just be reliably good or reliably bad. Is that too much to ask? Perhaps the optimal plan is to just figure out which of my models handles this team the best, then tail that one. *pause to look up at the stat graphic* dammit…Okay, Shorting Goalies had a good quarter, but that’s going to hit a brick wall if Shesterkin starts playing like Shesterkin again (both goalies were close to .894 Q2 SV%). At least I’m always aware of which teams I’m struggling with and post my cumulative results betting each team every week. This team could catch fire at any moment, so getting aggressive on the opposite side could prove costly whenever that spark gets lit.

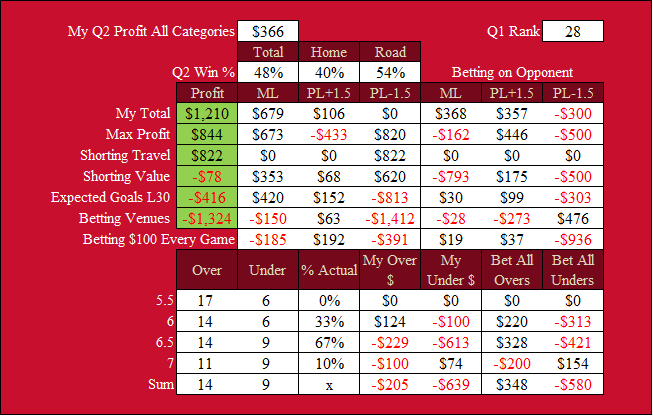

28) Chicago Blackhawks, (-$1,146):

Adding Connor Bedard to this team made them frisky, which kicked off game one of the season when they upset Pittsburgh (who was supposed to be a Cup contender but now we know are average at best). Though it was actually their over/under which gave me the biggest problem in Q1. There was a stretch from Dec 7 to Dec 27 where I bet Chicago 7 times in 10 games and there is an abundance of red ink for that portion of the Hawks schedule. Afterwards I grew increasingly aggressive betting them to lose, which was profitable at first, but then came back to bite me after the Connor Bedard injury when they beat Calgary and covered +1.5 against Edmonton.

Both Tailing History and Betting Venues absolutely crushed this team in the first quarter, as one of the underdogs delivering big jackpots on alt pucklines -1.5 goals, but that golden goose stopping laying eggs in Q2. Basically, I lost -$1,200 betting Petr Mrazek to lose, and won $600 betting Soderblom to lose. Mrazek did post a respectable .903 SV% while Soderblom was sieving it up with an .867. Mrazek won 6 of 17 starts, Soderblom went 0 for 7. It felt strange how often they were starting Mrazek, as Celibrini might be worth rolling struggling youngster out there for a few extra starts. It’s a little strange Expected Goals bet that much on Hawks to win, but closer inspection revealed they were mostly all vs back-to-backs.

29) Philadelphia Flyers, (-$1,214):

The Philadelphia Flyers exceeding expectations cost me some money early in the schedule, but once it became clear they were decent, my output improved. On the average I was coming out ahead, but they did have a few embarrassing losses when I picked them to win, and embarrassed a few opponents when I picked them to lose. One of the issues is that Betting Venues went from good to terrible picking Flyer outcomes. My new tendency is to lean on model recommendations when I’m indecisive, but that wasn’t a good strategy with this team. Thankfully most of my wagers were for my minimum amount, as getting aggressive with teams you have difficulty figuring out is potentially perilous.

This was a good team for Shorting Value and Expected Goals, but it’s too early to say if that will be transferable to the next quarter. I’m still new to the whole concept of betting negative value and re-training my brain has been difficult. This is getting to the point where I see a line that looks appealing, then immediately the doubt comes rushing in asking myself if that means bet the other side. In goal, Samuel Ersson went from bad to good (climbing from an .881 SV% up to .928) while Carter Hart remained the same. For a while they were getting a 50-50 split alternating games. Then Carter Hart left the team for criminal reasons early in Q3, and they appear to be collapsing (Ersson suddenly resumed sucking).

30) Washington Capitals, (-$1,216):

My strong performance betting the Washington Capitals in Q1 did not carry-over into December. The team went from good to bad in terms of overall win %, but they were good when I bet them to lose, and bad when I bet them to win. They kicked off the quarter by losing to San Jose, costing me $500. Then two nights later they beat LA. They suffered plenty of losses to middling teams, but also beat the Kings, Rangers, Hurricanes, and lost 6-0 to Arizona. The team’s issue was the scoring completely dried up, but the goaltending improved. Looks like Father Time may have struck a devastating blow in Ovechkin’s goal chase.

Darcy Kuemper is becoming a contender for my worst NHL contract award this summer, posting an .890 Q2 SV%. Thankfully for the team, Charlie Lindgren emerged as a stud, posting a .930 SV% (which was only good enough to win 4 of 10 starts). That new hierarchy didn’t help me at all, posting a large loss betting both goalies to win and lose. Kuemper actually won a higher percentage of his games despite being considerably worse. That was a big source of my own struggles. My Expected Goals model was also rocked by this team, both when betting them to win and lose, while Betting Venues sunk far too much money in Caps to win by at least 1.5 goals.

31) Columbus Blue Jackets, (-$2,046):

My performance betting the Columbus Blue Jackets did improve in the 2nd quarter, as they were a slightly better team. Goaltender Elvis Merzlikins entered the quarter on a heater but cooled off. Among my problems with this team is that they entered the quarter with their unders hot, then their overs got hot, then their unders got hot again. Trend shifting at the team level is a headache for anyone running over/under algorithms. Their goalies seemed to be either really good or really bad, which was the same case with the offense, leading to that dreaded “V” word…variance.

Elvis Merzlikins wound up missing time, then suddenly found himself on the bench in favor of Tarasov (who missed the start of the season and coach may have been making up for lost time). Elvis finished the quarter with a .905 SV% compared to Tarasov’s .876, so it’s understandable that he grew frustrated and asked for a trade (his contract might be difficult to move). They’re still near the bottom of my profitability rank, but the bleeding stopped a few months ago. If they can just be reliably good or reliably bad in the second half, then we’ll be cooking with gas. Elvis running hot or cold could deliver either, just not when he’s alternating back and forth.

32) Edmonton Oilers, (-$2,756):

My season from Hell betting the Edmonton Oilers continued in the second quarter, as this was the ultimate Jeckyl and Hyde team, who seem to either win 8-4 or lose 8-4. At least that’s how it felt watching their games, regardless of the actual number on the scoreboard. They fired their coach then immediately began dominating the competition. Then once they built up my confidence, they started struggling again. My Expected Goals L30 model loves taking Edmonton and enjoyed much success doing so. That being said, some of my models went from awesome to terrible betting specific teams one quarter to the next, while others went from bad to good. Keep that in mind.

The Oilers won 78% of their home games and 90% of their road games, and this has been an above average road team for most of the last 4 seasons. It’s the same deal with the Jets, it would seem both enjoy getting out of town (note to self: check Oilers record in warm weather cities). This team won 15 consecutive games as Q3 was underway (this was the final write-up completed) so it might be a while before I’m betting them to lose again. While they are in last here, they were my #1 most profitable team in the opening week of the second half (that’s continuing in week 2). I hope that momentum continues. Stuart Skinner was really bad in the first quarter but posted a .927 SV% in Q2 (catching fire immediately after being traded from my fantasy team).